- info@alkhanmuscatfinance.com

MANAGEMENT DISCUSSION AND ANALYSIS REPORT

OVERVIEW

AlKhan Muscat Finance Companies has completed 26 years of successful operations as a Non-Banking Financial Institution, offering a comprehensive range of financial products. Over its tenure of more than two and half decades, the company has established a strong market presence with robust systems and processes and has crossed many significant milestones. The following discussion and analysis provide information that the management believes, is useful in understanding our operating results and financial position. The discussion is based on our continuing operations and should be read in conjunction with our consolidated financial statements and related notes appearing elsewhere in this report. Certain statements in the MD&AR describing the company’s views, objectives, projections, estimates, expectations, etc. may be extrapolative within the ambit of applicable laws and regulations. Actual results could differ materially from those expressed or implied. Important factors like changes in government regulations, tax laws, interest rates in the domestic and international markets, demand and supply of capital goods, etc. may influence the company’s operating results.

WORLD ECONOMIC OUTLOOK

As we usher into the year 2023, the world economy continues to show fragility with global growth slackening in the face of elevated inflation, higher interest rates, reduced investment, and disruptions caused by Russia’s invasion of Ukraine. The IMF has forecasted 2.9% growth for 2023 as against 3.4% growth last year. The IMF sees the pace of global growth falling this year compared with 2022, but by a smaller margin than it predicted in October 2022 The US central bank has slowed the pace of its interest rate hikes but opines there will be ongoing increases as it continues to battle inflation. The Federal Reserve has recently increased its benchmark overnight interest rate by a quarter of a percentage point, taking it to a range of 4.50-4.75%. This follows six larger rises in a row. The FED Chair is of the opinion that though inflation has begun to slow, we can expect a couple of more rate hikes, though not very sharp, in the months ahead and we do not see the Fed cutting rates this year. The risks to the outlook remain tilted to the downside, even if adverse risks have moderated since October 2022 and some positive factors gained in relevance.

DOMESTIC ECONOMY

The sultanate adopted various fiscal measures over the past couple of years to support the economy including interest-free emergency loans, tax and fee reductions / waivers, the flexibility to pay taxes in instalments, a Job Security Fund to support citizens who lost their jobs and deferment of loan repayments as the economy was hit by a dual shock of the pandemic and a collapse in oil prices

Oman is on the path to moderate growth since October 2022, primarily driven by higher crude oil and gas prices and production coupled with increased tax collection. Oman recorded a budget surplus of RO 1.146 bn for the year 2022. The additional financial revenues enabled the government to pay off part of the public debt. Oman’s 2023 budget is based on a prudent average oil price of US$55 per barrel while the actual average for 2022 was above $94 per barrel. The oil price is expected to be stable in 2023. Also, the Omani government has been taking steps to diversify its economy away from its heavy reliance on oil by investing in sectors such as tourism, logistics, and manufacturing and these efforts are expected to bear fruit in 2023 and beyond. All these have prompted the major rating agencies to upgrade the credit rating of Oman resulting in enhanced confidence of foreign investors, corroborating the accomplishment of Oman’s financial & economic policies. However, there are significant works that still needs to be done to navigate through the existing challenges to put Oman on a more sustainable path.

The tightening of liquidity in the market leading to an unprecedented increase in the cost of funding could dent the economic growth prompting mainly the distressed borrowers opting for borrowing at these rates which would not only create immense pressure on the borrowers but may also result in higher delinquencies.

Opportunities and Threats

While the economy appears to have entered into a subdued recovery mode, policymakers still face daunting challenges - in debt management, liquidity management, budget policies, public health, central banking and structural reforms. The company has followed a prudent approach in writing new businesses with focus on maintaining the asset quality besides scouting for quality assets, keeping the non-performing loans under control. As the oil price continues to be stable, we can expect the authorities to pump in the necessary liquidity to ensure that the economy gains traction and gets the much-needed impetus for robust growth. The company has focussed and succeeded in rationalising costs and improved collection mechanisms leading to the achievement of lowest NPA ratio in the industry.

The company has over the years, planned the necessary human resources, enhanced the capital base and is continuously seeking to upgrade and develop IT system to address the need of the hour. The Company is upgrading its security aspects, hardware infrastructure and data-base and is in the process of diversifying its distribution channel through Mobile APP.

The company follows a prudent provisioning policy and this has given it an advantageous NPA coverage of 464% (including the specific reserve for non-performing assets) which will help the company to tide over any unforeseen losses. The company shall continue to maintain its provisioning stance subject to behaviour of the debt.

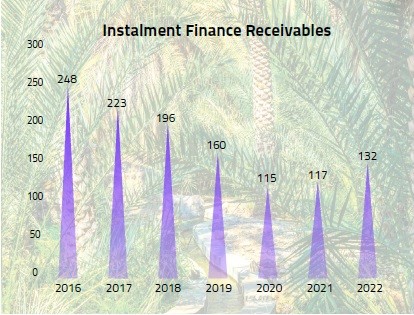

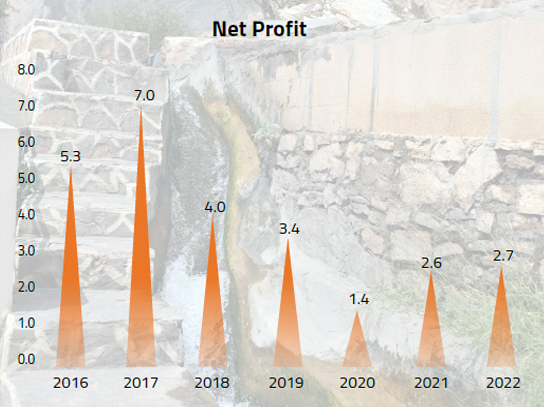

Product Wise Performance